Financial Consumer Protection Authority

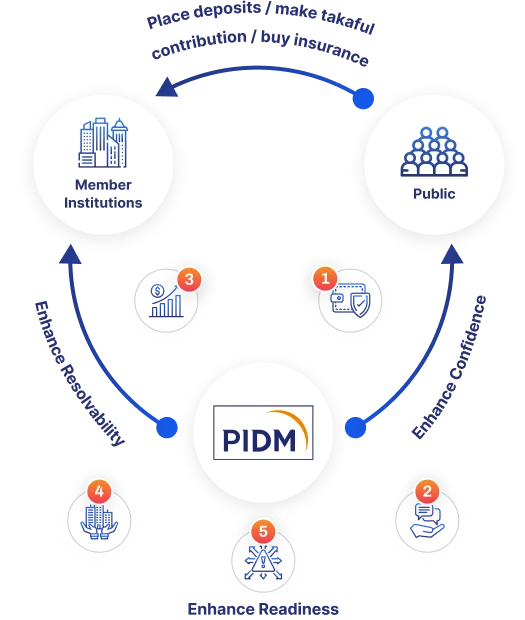

PIDM is a statutory body established in 2005 under the Malaysia Deposit Insurance Corporation Act (PIDM Act). In fulfilling our mandate as a financial consumer protection authority and resolution authority for our member institutions, PIDM protects financial consumers in Malaysia by:

1

Protecting deposits and takaful and insurance benefits

2

Creating awareness and enhancing trust

3

Providing incentives for member institutions to remain safe and sound

4

Ensuring member institutions can be resolved effectively

5

Enhancing readiness for crisis

How PIDM Protects Financial Consumers

How PIDM Protects Financial Consumers

PIDM provides automatic protection to financial consumers through Deposit Insurance System and Takaful and Insurance Protection System in the event of a member institution failure, covering eligible deposits up to RM250,000 per depositor per member bank and eligible takaful and insurance benefits up to RM500,000 per insurer member.

PIDM carries out extensive public awareness activities to ensure that consumers are aware that our protection systems exist and understand their benefits and limitations. This provides them with clarity, reassurance and confidence towards our financial protection systems in times of stress or uncertainty and helps to mitigate the risk of runs on our member institutions.

PIDM promotes sound risk management by collecting annual premiums and levies from our member institutions through the Differential Premium System framework for member banks (DPS), the Differential Levy System framework for insurance companies (DLS) and the Differential Levy System framework for takaful operators (DLST). Member institutions are charged based on their risk profiles under the DPS, DLS and DLST - the better the risk profile, the lower the premiums or levies, and vice versa. The premiums and levies are assessed and collected from member institutions during business as usual instead of after a failure.

As a resolution authority, PIDM’s role is to resolve a failing member institution promptly and effectively, which will help minimise disruption to financial consumers, preserve financial system stability and avert a potential broader economic crisis. We have a robust resolution framework that enables us to undertake a resolution in a prompt and orderly manner so that depositors can have continued access to their money. We have also put into place an integrated reimbursement system to enable timely reimbursement to depositors in the event of bank closure.

To enhance cooperation and coordination in crisis management and resolution, PIDM collaborates closely with fellow safety net players like Bank Negara Malaysia (BNM) and the Ministry of Finance through structured interagency arrangements and joint simulation exercises. This includes the development of an interagency crisis preparedness binder that provides clear and structured guidance to crisis response. Internationally, PIDM engages with foreign resolution authorities via MOUs and crisis management groups, participating in cross-border simulations to boost preparedness and coordination in handling crises effectively.