What happens if you have policies or certificates with multiple insurer members?

TIPS provides separate protection if you have multiple policies and certificates with more than one insurer member.

What happens if you have multiple policies or certificates with one insurer member?

Your protected benefits will be aggregated if you meet all the conditions below.

Same Insurer Member

Same Risk Event

Same Life Insured or Insured Property

Same Takaful Certificate or Insurance Policy Owner

Click the examples below for more information

Do you knowif your insurance company or takaful operator is an Insurer Member?

All insurance companies and takaful operators in Malaysia are automatically members of PIDM.

Just look out for the PIDM membership sign

List of PIDM Insurer Members

List of PIDM Insurer Members

List of PIDM Insurer Members

List of PIDM Insurer Members

But not all financial institutions are our members.

Click here to find out

Still not sure how Takaful and Insurance Benefits Protection System works?

Here's a video to help you understand better

What Should You Do If Your Insurance Company or Takaful Operator Can No Longer Operate?

DO NOTHING

PIDM will ensure continued takaful and insurance coverage

If the insurer member can no longer operate, PIDM will take action to ensure continuity of coverage under your takaful certificates and insurance policies.

What if the insurer member has to be closed down?

If you have a claim but the insurer member has already closed down, PIDM will make a payment of the protected benefits to you.

Discover PIDM's Resolution Authority Role.

Learn More

So, What Can I Do

Right Now?

Each takaful or insurance policy is unique, with benefits tailored to your personal needs. Speak to your takaful or insurance provider to understand which benefits are covered by PIDM.

Why PIDM Protection

Matters?

Your peace of mind is our priority.PIDM ensures that you remain protected, even if your insurance company or takaful operator is no longer able to operate. You can always count on us for continuous protection to your insurance policy and takaful certificate. So go ahead and live your life with confidence as PIDM has got you covered!

Read more in our FAQs:

About PIDM

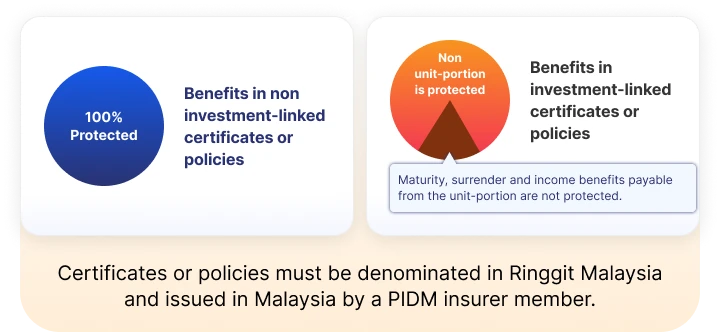

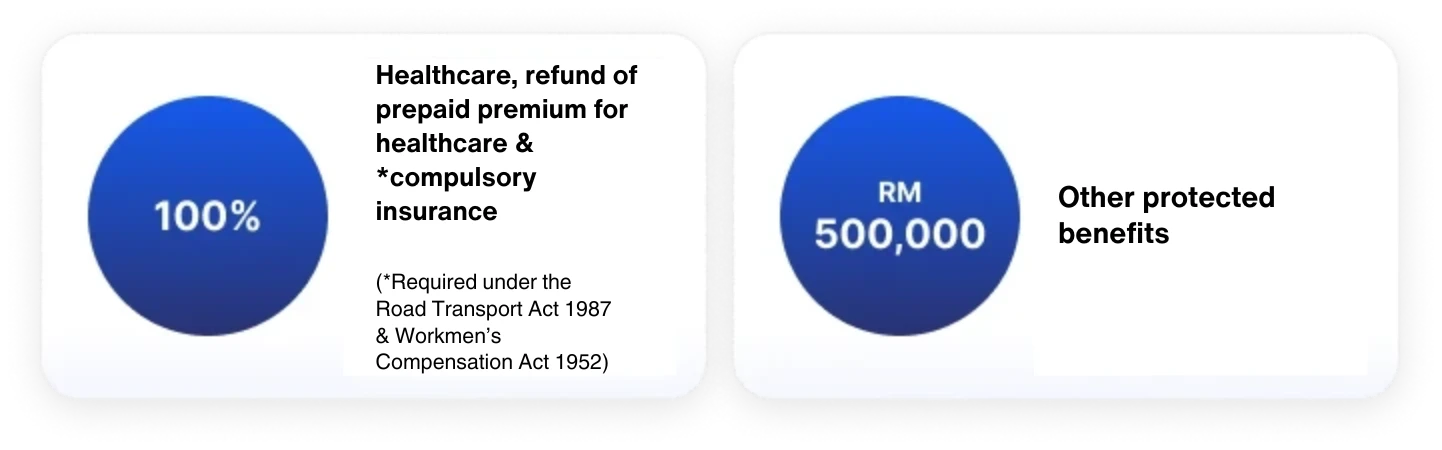

Takaful and Insurance Benefits Protection System (TIPS)

Download: Brochure

Download: Brochure