Resolution Planning

What is Resolution Planning?

Resolution planning is about being prepared before a crisis hits. It ensures there are clear and tested plans in place so that if a failure happens, it can be managed in a prompt and orderly manner.

At the moment, resolution planning is only applicable to PIDM member banks.

Why Resolution Planning Matters?

Banks plan for growth, rarely for their own demise. But history has shown that failures can happen, often without warning and the consequences can be severe, if not prepared.

Resolution planning ensures that if a member bank fails, PIDM can act quickly and decisively in a more prepared basis to manage the failure. It entails the collective efforts by PIDM and the member bank to put in place the necessary operational capabilities, such as contractual arrangements, systems and governance to support the resolution that is tailored to the specificities of the member bank.

Planning for resolution is not only meant for a crisis, neither does it infers that a member bank is likely to experience problems. Resolution planning can also be used as a strategic planning tool by the member banks where the operational capabilities such as enhancement in IT and managament information systems can also help to enhance operational efficiency and resilience of the member banks during business as usual.

Benefits of Resolution Planning

Resolution planning is not just about crisis readiness. It can also be a strategic tool to help member banks:

- Strengthen governance and clarify roles at board and management level;

- Improve operational efficiency (e.g., data systems, processes) and business continuity; and

- Enhance risk monitoring and crisis response, making the bank more resilient.

What Does Resolution Planning Involve?

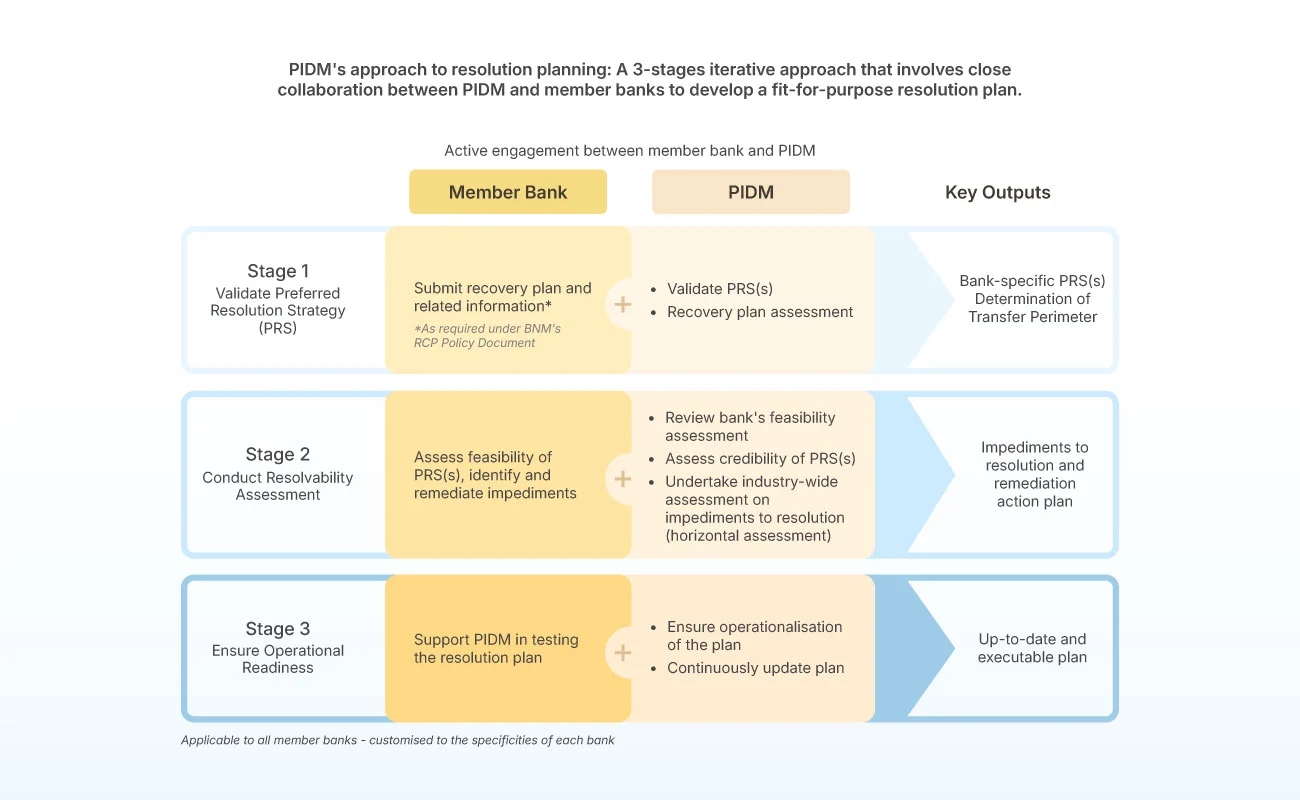

Resolution planning involves a 3-stage iterative process to develop a feasible and credible resolution plan that sets out the actions that PIDM would take to deal with a member bank if it fails. The resolution plan is customised to each member bank, taking into consideration its size, structure and complexity. PIDM may share and discuss key aspects of the resolution plan with the member bank to facilitate understanding, coordination and development of the resolution planning work.

PIDM’s resolution planning process is designed in three stages as depicted in the diagram below.

Stage 1: Validate Preferred Resolution Strategy (PRS)

PIDM’s preferred way to handle a failing member bank (preferred resolution strategy) is to transfer all or parts of its business, assets and liabilities or shares to another institution. This helps ensure continuity of critical banking services while protecting depositors and maintaining financial stability. This strategy seeks to preserve and extract higher franchise value and would also minimise disruptions to the financial system.

To begin, PIDM reviews and uses information in the bank’s recovery plan to validate the preferred transfer strategy and determines parts of the bank that may be transferred in the most efficient manner during a resolution considering the member bank’s group structure, business profiles, inter-dependencies and complexity. If needed, PIDM may determine an alternative approach and/or request the bank to provide more information to support the planning process.

Stage 2: Conduct Resolvability Assessment

The next step is to assess how executable the strategy is (feasibility assessment). Given that the member bank knows its own structure and business operations best, PIDM works with the member bank for an assessment to be carried out by the member bank to establish the feasibility on implementing the preferred resolution strategy in a crisis. It examines any potential impediments such as legal, financial and operational challenges that could hinder a prompt and effective resolution of the member bank. During this stage, PIDM works with the member bank to address related impediments and to strengthen its readiness to implement the preferred resolution strategy, which is a transfer strategy customised for the member bank. This will then culminate into a customised resolution plan for the member bank.

In addition, PIDM also assesses the credibility of the resolution plan developed by PIDM together with the member institution (credibility assessment), and works with Bank Negara Malaysia to address broader issues or industry-wide impediments that may affect multiple institutions or the banking system in resolution.

Stage 3: Ensure Operational Readiness

Based on findings from the resolvability assessment, PIDM works with the member bank to ensure effective operationalisation of the resolution plan. To ensure this plan works as intended, the plan may then be tested through simulations, dry-runs or fire drills. Enhancements will then be made to the plan based on the findings from the testing or simulation exercises.

Resolution planning is not a one-off exercise that requires a one-time effort. As the member bank’s business, risks and operating environment evolve, so too must its readiness for resolution. Member banks are expected to support PIDM to review and update their resolution plans to ensure they remain current and relevant.

Who are Involved in Resolution Planning?

Being ready for resolution is a shared responsibility. Resolution planning involves mainly PIDM as the resolution authority, the member bank itself which provides deep operational knowledge and support to put in place the necessary operational capabilities to support a resolution, and other safety net players such as Bank Negara Malaysia that play a key role in supervising and regulating the member banks.

At the same time, PIDM also works with other foreign authorities to cooperate and coordinate on matters relating to cross-border crisis preparedness concerning member banks that have cross-border presence. In essence, PIDM leads and coordinate with relevant stakeholders, both locally and internationally, to ensure that issues and impediments to resolution are promptly identified and addressed, both at the specific bank level or industry-wide level.

To learn more about resolution planning, please refer to FAQs here.