About Resolution

What is Resolution?

One of PIDM’s core missions is to help preserve the stability of the Malaysian financial system. As part of that mission, PIDM has the statutory responsibility to manage the failure of our member institutions in a prompt and orderly manner if they can no longer operate in a viable manner. This process is known as resolution.

When PIDM plans for or carries out a resolution, we are guided by these objectives:

- Ensure continuity of financial services that are critical to the Malaysian economy;

- Preserve the stability of the Malaysian financial system;

- Preserve public confidence;

- Protect deposits, insurance and takaful benefits covered by PIDM; and

- Minimise costs, contagion risks and disruption to the Malaysian financial system.

PIDM as the Resolution Authority

As the resolution authority for our member institutions, PIDM is responsible for planning and executing resolution in a prompt and orderly manner. This means minimising disruptions, ensuring customers can continue to access important financial services, and reducing the impact on depositors, policy owners, and the wider economy.

Our main goal is to preserve public confidence and protect the stability of Malaysian financial system.

When Does Resolution Happen?

When a member institution experiences severe financial distress and can no longer restore its viability on its own, Bank Negara Malaysia (BNM), as the primary regulator and supervisor, may determine that the institution is no longer viable to operate as a going concern licensed financial institution (Note: This event is also known as the “non-viability” event or trigger under Section 98 of the PIDM Act 2011). Once this happens, PIDM steps in to take control of the failing institution and begins the resolution process.

In making this determination, Bank Negara Malaysia considers a range of factors such as capital, liquidity, profitability, business viability, and management of the institution.

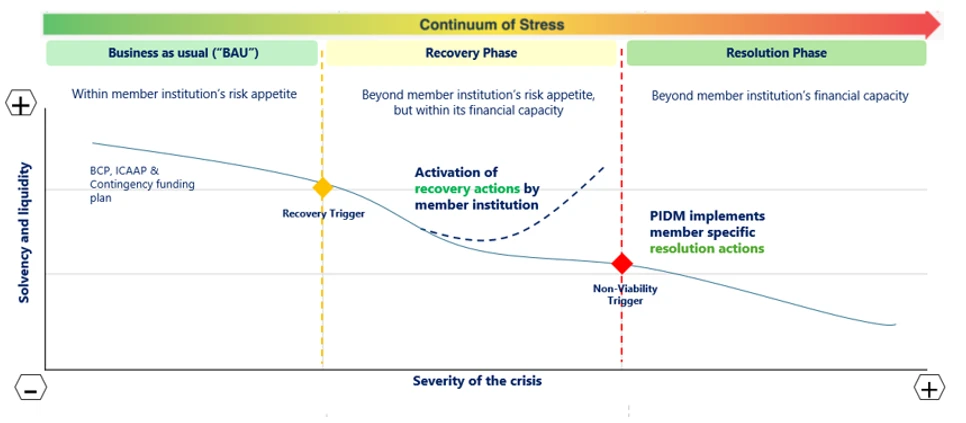

This diagram explains how a member institution manages rising levels of financial stress under an integrated risk management framework. It outlines three key phases: Business as Usual (BAU), Recovery and Resolution. Each phase reflects a different level of financial stress and different set of tools to respond safely and effectively.

Business as Usual

In this phase, the member institution is operating normally. Financial and operational risks are within its defined risk limits (risk appetite). During this time, it relies on established internal processes such as the Internal Capital Adequacy Assessment Process (ICAAP), Contingency Funding Plan and Business Continuity Planning (BCP) to plan, monitor risks, manage day-to-day operations, and prepares for unexpected events that is within its risk appetite and financial capacity.

Losses during this phase can typically be absorbed using the institution’s own resources.

In summary: This phase reflects a normal and stable operating environment where the institution is well-positioned within its risk appetite and capacity to continue operating as business as usual.

Recovery phase

When a member institution experiences serious financial stress, for example, a severe fall in capital, loss of funding, or sharp decline in market confidence – so severe that the stress event or loss exceeds the institution’s risk appetite, but still within its financial capacity and control – the institution enters the recovery phase.

At this point, a recovery trigger is met. The institution then activates its Recovery Plan, prepared and tested in advance, which may include:

- Selling non-core assets;

- Raising additional capital;

- Cutting costs; and/or

- Securing emergency funding.

These actions are carried out proactively by the institution under the supervision of Bank Negara Malaysia, with the aim of restoring its financial health and avoiding further deterioration that could lead to failure.

In summary: The recovery phase is about acting early and decisively to restore the institution’s health and return it to business as usual as quickly and safely as possible.

Resolution phase

If conditions worsen and the institution can no longer recover on its own, this may trigger a non-viability. This determination is made by Bank Negara Malaysia, based on factors such as capital, liquidity, profitability, business viability, the confidence of Bank Negara Malaysia over the management of the institution and extent of regulatory non-compliance.

Once this happens, the institution enters the resolution phase and PIDM steps in as the resolution authority to resolve the failing institution. PIDM activates the Resolution Plan, developed in advance and tailored to the institution. The plan outlines how the institution’s failure will be managed in a prompt and orderly manner. This could include for example:

- Selling the institution (or parts of it) to another party;

- Restructuring the institution; or

- Winding down the institution, while ensuring depositors are protected and critical services continue.

The goal of resolution is to protect deposits, insurance and takaful benefits covered by PIDM, minimise disruption and contagion, and preserve public confidence and financial stability.

In summary: Resolution is the final safety net, ensuring that even if a member institution fails, it does so in a way that minimises impact on depositors, customers and the wider economy.

Interagency Coordination in Resolution

To ensure effective resolution, PIDM works closely with other financial safety net authorities such as Bank Negara Malaysia and the Ministry of Finance to coordinate on strategic policies, manage distressed member institutions, strengthen crisis preparedness and resolution planning, including addressing institution-specific and industry-wide impediments to resolution.

We also engage with foreign authorities through platforms such as the Crisis Management Groups (CMGs) to plan and prepare for cross-border resolutions involving member institutions with overseas operations or foreign parent holding companies to ensure a well-coordinated and effective resolution process across borders.

Together, we aim to protect financial stability and maintain public confidence during a resolution, both in Malaysia and internationally.

Funding Arrangement in Resolution

When a member institution fails, its own resources – including its assets, capital (such as retained earnings and shareholder’s equity) and additional financial support, if any, are the first in line to absorb losses. This is a fundamental principle of resolution.

Additionally, PIDM may use the premiums or levies it collects annually from its member institutions to fund and support prompt and orderly resolutions, when needed.

If further funding is required to carry out an effective resolution, PIDM also has the legal authority under the PIDM Act to raise funds from external sources, including:

- Borrowings from the Government - The Minister of Finance may provide loans to PIDM to meet resolution-related obligations, based on mutually agreed terms and conditions.

- Issuance of debt securities - PIDM may raise funds by issuing bonds or other debt instruments, particularly when market conditions are favourable.

- Other sources - PIDM may also explore additional funding sources as it deems appropriate and necessary.

This multi-pronged funding framework ensures that PIDM is financially prepared to act swiftly and decisively during a resolution.